NYC Power of Attorney

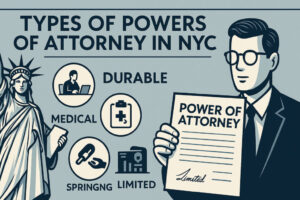

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A Power of Attorney (POA) is a legal document that allows you to appoint someone you trust to act on your behalf in financial and/or medical matters if you become unable to do so yourself. Whether you’re a young professional, a business owner, or a senior citizen, understanding the importance of a POA and having the right documents in place can provide invaluable peace of mind. Navigating this may feel difficult, but it should not be a weight on your back. At Morgan Legal Group, we hope to provide peace and clarity for these moments. This